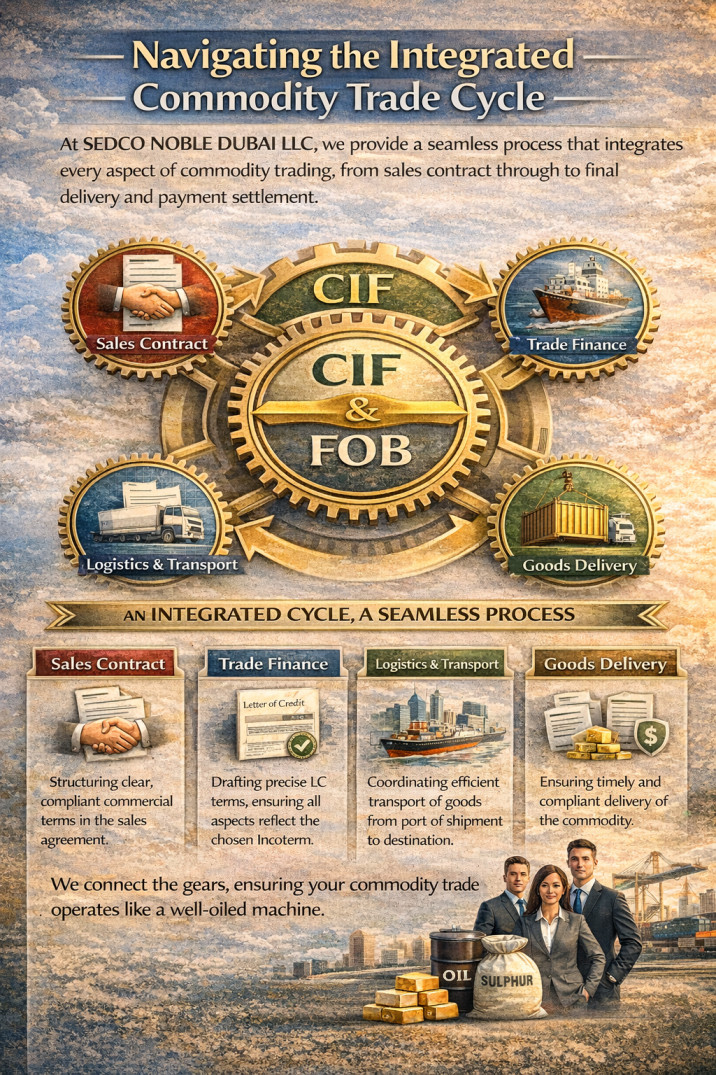

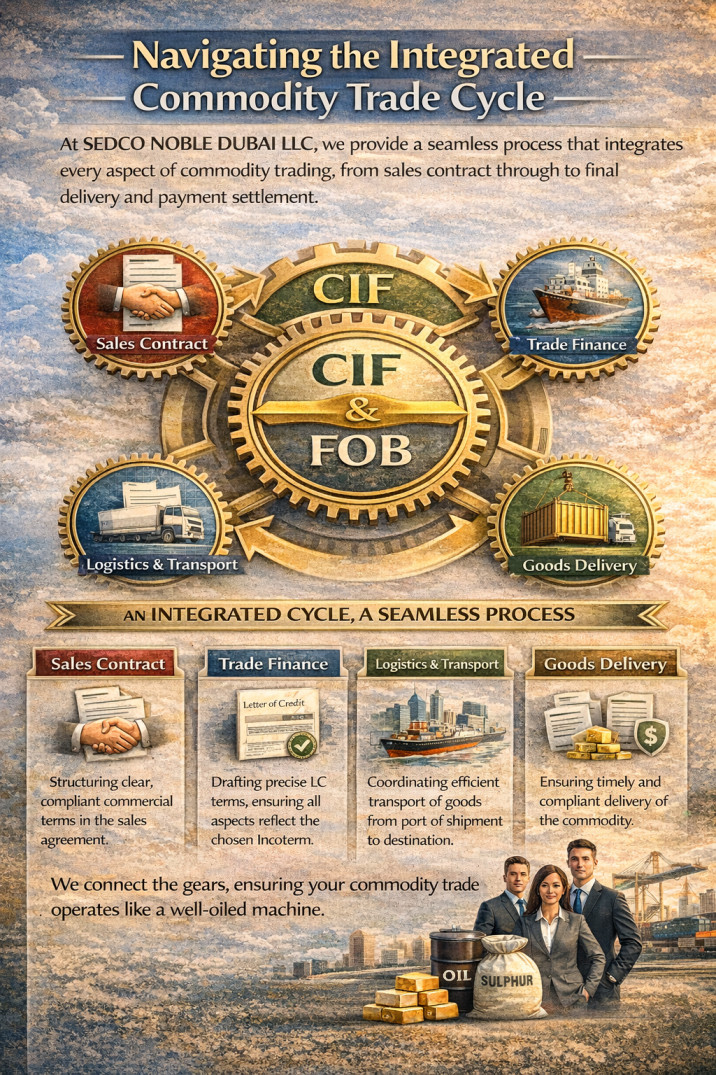

Seamless Execution from Origin to Destination: Integrating CIF/FOB Strategy with End-to-End Trade Finance

How SEDCO NOBLE Manages the Complete Transaction Loop—From Incoterm Selection to Final Delivery and Payment

Stay informed with the latest updates on sulphur trading, gold trading, trade finance, and market analysis from industry experts.

How SEDCO NOBLE Manages the Complete Transaction Loop—From Incoterm Selection to Final Delivery and Payment

A Strategic Guide to Allocating Risk and Cost with Your Trade Finance Partner

Leveraging Geographic & Infrastructural Excellence for Optimized Commodity Flow and Financial Execution

How SEDCO NOBLE DUBAI LLC Leverages Its DIFC Base to Deliver Security, Speed, and Certainty in Global Transactions

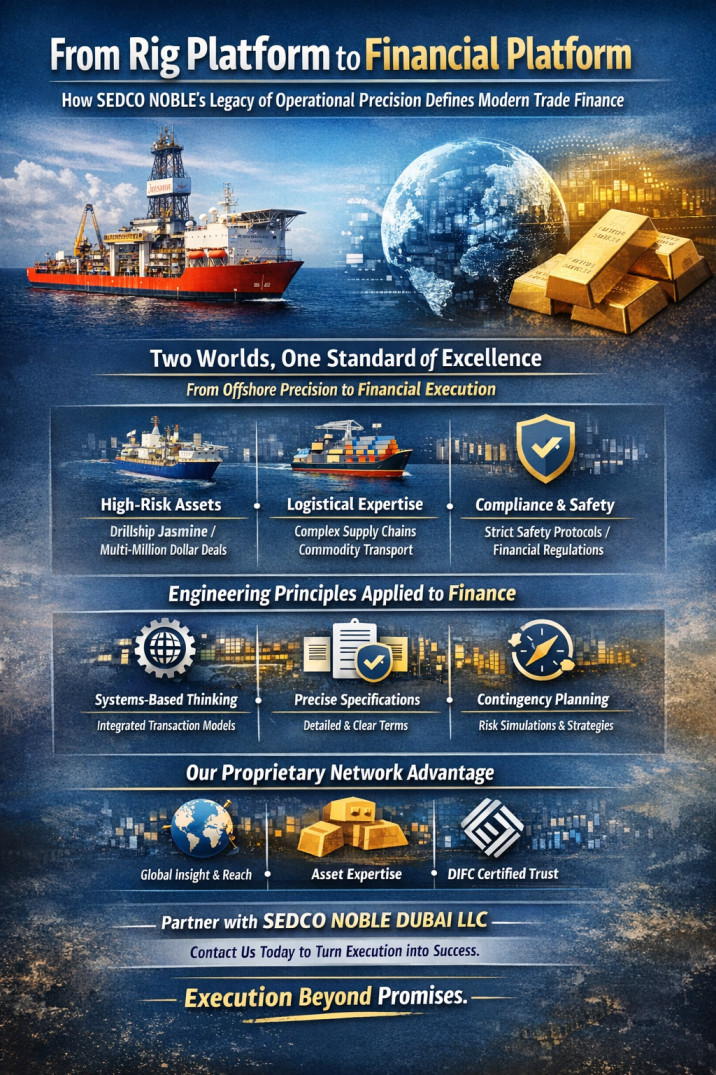

For decades, the name SEDCO NOBLE was synonymous with operational excellence in some of the world's most challenging environments. As the drilling arm of Noble Resources, we...

The Unbroken Thread Between Managing Deepwater Drilling Operations and Structuring Complex Commodity Transactions

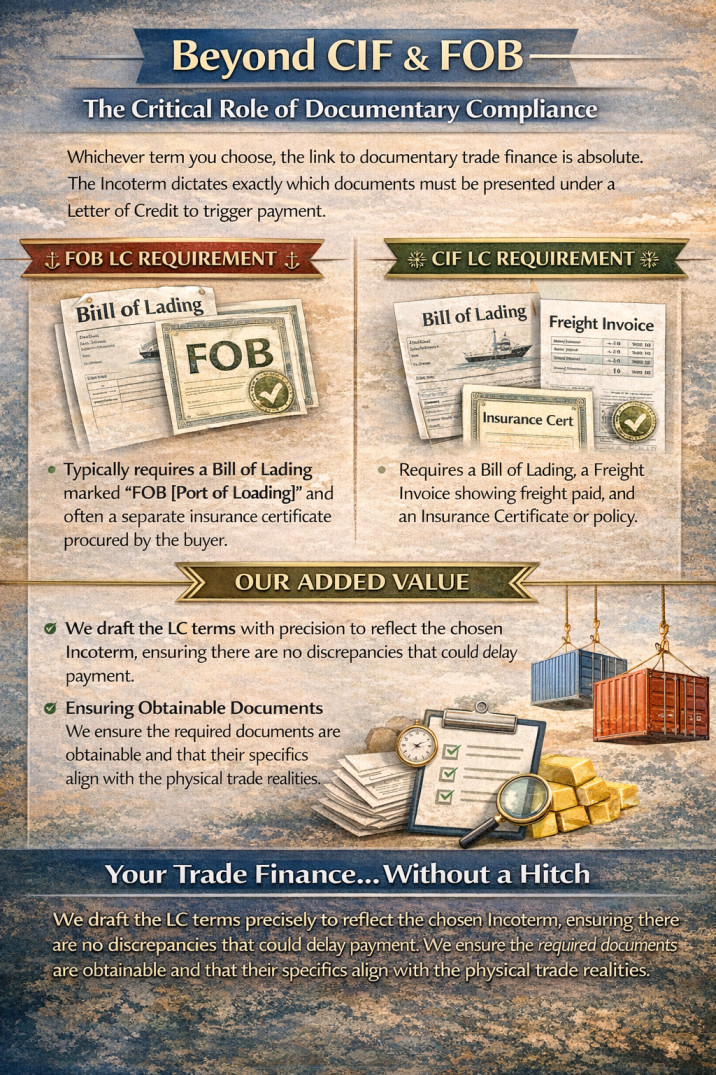

Choosing the Right Instrument Can Mean the Difference Between a Flawless Trade and a Costly Dispute. Here’s Your Guide.

How SEDCO NOBLE DUBAI LLCs Unique Co-Investment Model Redefines Client-Aligned Financing in Commodity Markets

Transaction-Specific Structuring: We design financial instruments that mirror the transactions physical flow. For sulphur, this might involve structured payment milestones linked to assay results at trans-shipment points. For gold, it could entail escrow mechanisms and tailored Bank Guarantees that secure both buyer and seller through minting and delivery.